Buy The Book

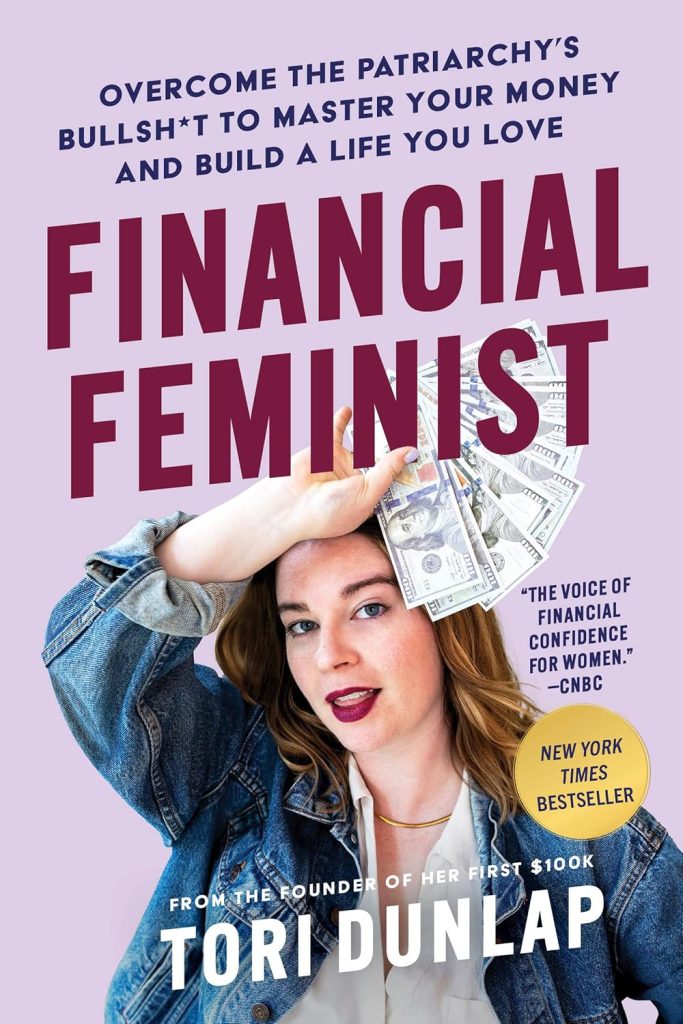

Financial Feminist

About

Tori Dunlap is a financial educator and entrepreneur, best known for her mission to empower women to take control of their financial futures. Through her platform, Her First $100k, Dunlap has made significant strides in promoting financial literacy, particularly among young women. Her debut book, “Financial Feminist,” expands on this mission by addressing the unique financial challenges women face in a society that often undermines their economic empowerment.

In “Financial Feminist,” Dunlap provides readers with practical advice and actionable tips to achieve financial independence and break free from societal constraints. The book is structured around personal anecdotes and relatable stories, making complex financial concepts accessible and engaging. Key themes include the importance of budgeting, investing, negotiating salaries, and understanding one’s worth. Dunlap emphasizes the need for women to advocate for themselves financially and dismantle the systemic barriers that contribute to the gender wealth gap.

By blending her expertise with personal experiences, Dunlap inspires readers to view financial education as a crucial element of feminism. “Financial Feminist” serves not only as a guide for financial success but also as a rallying call for women to reclaim agency over their financial lives and build a more equitable future.

Spark

Learn

Review

✦ Chapter 1: The Emotions of Money

Money often feels like a taboo subject, one loaded with deep-seated emotions that are rarely addressed openly. It’s not just about numbers—money represents security, power, freedom, or sometimes even shame and fear. These feelings are heavily influenced by personal experiences, upbringing, and societal norms. Reflecting on how early experiences with money shaped financial attitudes reveals a lot about current behaviors. For example, growing up in a household where money was scarce may lead to fear-driven saving or overspending as a way to compensate for past deprivation. On the other hand, someone raised with financial privilege might struggle to relate to the value of money or feel guilt about their advantages.

Cultural and gendered expectations also play a significant role in shaping financial emotions. Women, in particular, are often conditioned to think of money as a source of shame—whether it’s about not earning enough, earning too much, spending “incorrectly,” or not being educated enough about finances. These narratives perpetuate cycles of guilt and financial insecurity, especially when combined with systemic barriers like wage gaps and the lack of financial literacy resources tailored to women.

The key to breaking these cycles is first to acknowledge and validate the emotions tied to money. Rather than ignoring or suppressing feelings of guilt, fear, or shame, examining their origins can help dismantle the limiting beliefs that hold people back. Reframing the relationship with money involves recognizing that emotions are natural and do not signify financial failure or incompetence. This process isn’t about perfection but about progress—learning to navigate money without self-judgment or shame.

Taking control of finances begins with self-compassion and the understanding that money is neither inherently good nor bad; it’s a tool to create the life one desires. By identifying and working through emotional blocks, it becomes easier to approach financial decisions with clarity and confidence. The focus shifts from being reactive to proactive, empowering individuals to make choices that align with their values and goals. Ultimately, financial empowerment starts not with numbers on a spreadsheet but with the courage to unpack the emotions and stories attached to money, rewriting them into ones of resilience, strength, and self-worth.

✦ Chapter 2: Spending

Spending is one of the most visible and immediate ways people interact with money, but it’s often fraught with guilt, judgment, and societal pressures. Every spending decision reflects underlying priorities, habits, and values, yet many struggle to spend with intention. Advertising and societal norms constantly encourage overspending, urging people to equate material possessions with success or happiness. At the same time, there’s a cultural tendency to shame certain spending choices, particularly for women, like buying self-care items, clothing, or things labeled as “frivolous.” This double standard creates a complicated and often unhealthy relationship with spending.

Mindful spending becomes a powerful way to take back control. Rather than feeling pressured by external influences, it’s about aligning purchases with personal values and long-term goals. The focus shifts from instant gratification or keeping up appearances to making thoughtful decisions that truly enhance life. This approach doesn’t mean cutting out all indulgences or living under strict financial constraints; instead, it’s about assigning purpose to every dollar. Spending on things that bring genuine joy or convenience, like a latte that brightens the morning or paying for childcare to free up time, holds as much value as saving for larger goals.

Letting go of guilt around spending is just as important as reworking habits. Many feel shame for buying things that make life easier or more enjoyable, but this mindset often leads to deprivation and binge-spending cycles. Financial freedom is rooted in balance—investing in both the present and the future. This includes creating a budget that reflects personal values and allows room for joy, rather than one that feels restrictive or punitive.

Boundaries around spending are equally critical, particularly in navigating societal pressures to over-consume or impress others. Saying no to unnecessary expenses becomes easier when spending decisions are grounded in a clear understanding of what truly matters. It’s not about chasing perfection but about spending with clarity and intention.

Ultimately, spending becomes less stressful and more empowering when approached thoughtfully. Every purchase reflects a choice, and by making those choices consciously, alignment between finances and personal priorities is achieved. This creates a healthier, more sustainable financial relationship that eliminates guilt and fosters confidence in decision-making.

✦ Chapter 3: The Financial Game Plan

Creating a financial game plan is essential for achieving stability and long-term success. A solid strategy begins with clarity—understanding income, expenses, and financial goals. Without this foundation, it’s difficult to make meaningful progress. The process starts with taking an honest look at current financial habits and identifying areas for improvement. Breaking down financial goals into smaller, actionable steps makes them more manageable and less overwhelming, whether it’s building an emergency fund, paying off debt, or starting to invest.

Saving for emergencies is one of the core pillars of any financial plan. Life is unpredictable, and having a cushion to rely on provides peace of mind and prevents setbacks from derailing progress. Automating savings is a powerful way to ensure consistency and remove the emotional burden of deciding when and how much to save. Similarly, automating bill payments and investments streamlines the process, making it easier to stay on track without constant oversight.

Debt repayment is another critical component, especially for those carrying student loans, credit card balances, or other forms of debt. Tackling high-interest debt first while continuing to contribute to savings ensures a balanced approach that doesn’t sacrifice future growth for short-term relief. Investing, while often intimidating, is one of the most effective ways to build long-term wealth. Starting small and taking advantage of employer-sponsored retirement accounts or low-cost index funds can make investing accessible, even for beginners.

Budgeting plays a central role in the financial game plan, but it’s reframed as a tool for empowerment rather than restriction. A well-designed budget aligns with personal priorities, allowing for both present enjoyment and future security. It’s not about cutting out everything enjoyable but about ensuring each dollar serves a purpose. Allocating funds for fun or self-care is just as important as saving and paying bills, as it prevents burnout and fosters a positive financial mindset.

Adaptability is key, as life circumstances are bound to shift over time. Whether it’s a career change, unexpected expense, or new financial goal, a flexible plan ensures that progress continues without feeling derailed. The ultimate goal is to create a system that works in the background, reducing stress and freeing up mental energy. A strong financial game plan isn’t just about numbers—it’s about creating a roadmap to achieve personal goals with clarity and confidence.

✦ Chapter 4: Debt

Debt carries a significant emotional and financial burden, often rooted in societal expectations and personal circumstances. It frequently feels overwhelming, with shame or guilt attached to it, but it is essential to approach debt not with judgment but with a strategic mindset. The first step is to understand the type of debt you’re dealing with—whether it’s high-interest credit cards, student loans, or other obligations—and to assess how it impacts your overall financial situation. Knowing the details, such as interest rates, balances, and minimum payments, helps create a clear plan for tackling it.

One effective strategy is prioritizing high-interest debt first, as it accumulates the fastest and costs the most over time. Focusing on this type of debt while continuing to make minimum payments on others ensures progress without neglecting obligations. Alternatively, paying off smaller balances first can build momentum and confidence, depending on what feels most manageable. The key is finding an approach that works for your situation and sticking with it consistently.

Automation becomes a valuable tool in managing debt repayment. Setting up automatic payments ensures deadlines are never missed, reducing the risk of late fees or additional interest. It also removes the mental load of remembering to make payments, making the process smoother and less stressful.

Debt repayment isn’t just about numbers; it also requires a shift in mindset. Letting go of the shame associated with carrying debt is vital. Many people find themselves in debt due to systemic issues like the rising cost of education, stagnant wages, or medical expenses, which are often beyond individual control. Blaming yourself only adds to the emotional weight and makes it harder to move forward. Treating debt as a problem to solve, rather than a personal failing, makes all the difference.

Alongside repayment, it’s important to create a plan for avoiding future debt. Building an emergency fund, even if it’s just a few hundred dollars at first, prevents reliance on credit cards for unexpected expenses. Long-term financial stability comes from both paying off past obligations and setting up systems to avoid falling into the same patterns. Debt doesn’t define your worth, and taking control of it is a powerful step toward financial freedom.

✦ Chapter 5: Investing

Investing may seem intimidating at first, but it’s one of the most effective ways to build wealth and achieve long-term financial goals. It’s not just for the wealthy or those with advanced financial knowledge—anyone can start with small amounts and grow over time. The first step is understanding the basic concepts, such as how compound interest works and the types of accounts and tools available. Compound interest allows your money to grow exponentially, as earnings are reinvested and generate even more returns. Starting early, even with modest contributions, takes advantage of this powerful effect.

Choosing the right investment account depends on your goals. Retirement accounts, like 401(k)s or IRAs, offer tax advantages and are ideal for long-term growth. Employer-sponsored accounts often come with matching contributions, which is essentially free money that shouldn’t be left on the table. For goals outside of retirement, brokerage accounts provide flexibility, allowing you to invest in stocks, bonds, index funds, or other assets. Understanding the risk level of different investments helps align choices with your comfort level and timeline.

Index funds and ETFs (exchange-traded funds) are excellent options for beginners, as they provide diversification—spreading your money across many investments to reduce risk. They are also low-cost and require less hands-on management, making them accessible to those without extensive financial expertise. Consistency is key when it comes to investing. Setting up automatic contributions ensures regular deposits, whether it’s monthly or with every paycheck, and removes the temptation to skip or delay investing.

Investing isn’t just about building wealth; it’s about creating opportunities and independence. It provides a path to financial security, the ability to retire comfortably, and the freedom to make choices without being constrained by financial limitations. Overcoming the fear of investing starts with education and small steps. You don’t need to know everything to begin—what matters is taking action and learning as you go.

While investing carries risks, the biggest risk is not investing at all. Keeping money in a savings account erodes its value over time due to inflation, whereas investing allows it to grow and outpace inflation. By focusing on long-term strategies and avoiding emotional decisions based on market fluctuations, it becomes possible to build a future of financial stability and empowerment.

✦ Chapter 6: Earning

Earning more money is one of the most powerful tools for improving financial security and achieving personal goals. While cutting expenses has its limits, increasing income creates opportunities to pay off debt, invest, and save more effectively. However, many people, especially women, face barriers when it comes to earning what they deserve. Overcoming these obstacles starts with recognizing your worth and advocating for yourself in professional settings.

A key aspect of increasing income is negotiating pay. Many feel uncomfortable asking for more money, but preparation and confidence make all the difference. Researching salary ranges in your field and location provides a benchmark for understanding what you should be earning. Highlighting your accomplishments and the value you bring to your role strengthens your case during negotiations. It’s not about being pushy—it’s about ensuring fair compensation for your work. Practicing these conversations in advance helps build confidence and reduces anxiety.

Diversifying income streams is another effective strategy for increasing earnings. Relying solely on one job can feel limiting, especially if opportunities for raises or promotions are scarce. Exploring side hustles, freelancing, or turning hobbies into income-generating ventures provides additional financial security and flexibility. These alternative income sources can also serve as a creative outlet or a way to explore passions outside of traditional work.

Addressing systemic challenges, such as the gender pay gap, requires both individual action and collective advocacy. While negotiating and pursuing opportunities are essential, it’s also important to push for broader changes in workplace policies, transparency, and equity. Supporting others in their financial journeys, whether by sharing knowledge or encouraging them to advocate for themselves, contributes to dismantling systemic barriers over time.

Earning more isn’t just about increasing your paycheck—it’s about creating freedom and options. With higher income, it becomes easier to save for future goals, reduce financial stress, and invest in experiences or things that bring joy. It also provides the ability to give back to causes you care about or support others in need. Recognizing your earning potential and taking steps to maximize it is an act of empowerment. Whether through career growth, negotiation, or creative side pursuits, increasing income is an essential part of building a sustainable and fulfilling financial future.

✦ Chapter 7: Living a Financial Feminist Lifestyle

Living a financial feminist lifestyle involves more than just managing money—it’s about aligning financial choices with values and creating a life of empowerment, equity, and purpose. Financial feminism recognizes that systemic barriers disproportionately affect women and other marginalized groups, and it seeks to challenge those inequities while building individual and collective wealth. This lifestyle is rooted in making intentional financial decisions that reflect personal priorities while addressing broader societal issues.

One way to embrace financial feminism is by supporting businesses and causes that align with your values. Spending money is an opportunity to vote with your dollars, whether it’s choosing companies that prioritize sustainability, equity, or ethical practices, or supporting small, women-owned businesses. This approach ensures that financial choices have a positive impact beyond personal benefit.

Community plays a significant role in living a financial feminist lifestyle. Sharing knowledge, resources, and encouragement with others creates a ripple effect, helping more people achieve financial stability and independence. Breaking the taboo around money by having open, honest conversations dismantles shame and fosters a sense of solidarity. It’s not just about personal success—it’s about uplifting others and advocating for systemic change.

Creating boundaries around finances is also essential. This includes saying no to societal pressures, such as overspending to keep up appearances, and setting limits that protect your well-being. Defining what financial freedom means to you allows for a more intentional and fulfilling approach to money. It’s not about adhering to anyone else’s standards but about creating a life that aligns with your unique goals and values.

Financial feminism also involves recognizing privilege and using it to advocate for change. For those with financial stability, there’s an opportunity to give back—whether through charitable donations, mentoring, or supporting policies that advance equity and inclusion. Small actions, like helping someone negotiate a raise or sharing financial tips, contribute to a larger movement for systemic change.

Ultimately, living a financial feminist lifestyle is about empowerment—both personal and collective. It’s about taking control of your financial future while working toward a more equitable world. By aligning money with values, fostering community, and advocating for change, financial feminism becomes a powerful tool for creating a life of purpose, freedom, and impact.

For People

– Young Women Seeking Financial Independence

– Individuals Interested in Financial Literacy

– Women Navigating Career Transitions

– Feminists Advocating for Economic Equality

– Entrepreneurs Looking to Build Wealth

Learn to

– Enhanced Understanding of Personal Finance

– Practical Strategies for Budgeting and Saving

– Confidence in Negotiating Salaries and Raises

– Insight into Investing and Wealth Building

– Tools to Address and Overcome Gender Wealth Gaps