Buy The Book

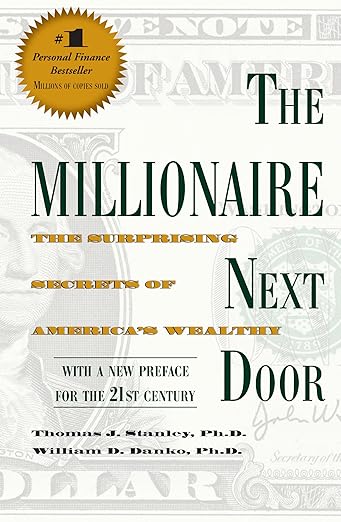

The Millionaire Next Door: The Surprising Secrets of America’s Wealthy

About

“The Millionaire Next Door,” co-authored by Thomas J. Stanley and William D. Danko, challenges common stereotypes about wealth. Stanley, a researcher and author specializing in the affluent, spent decades studying how people truly become millionaires. The book reveals that most American millionaires are not flashy spenders living in luxury, but rather frugal, disciplined individuals who live below their means.

Based on extensive surveys and interviews, Stanley and Danko demonstrate that these “ordinary” millionaires prioritize financial independence over social status, carefully budgeting, avoiding debt, and investing wisely. They often work in unglamorous professions and reside in modest neighborhoods. The book offers practical insights into the habits and mindset of those who successfully accumulate wealth, emphasizing the importance of long-term planning and financial discipline for achieving lasting prosperity.

Spark

Learn

Review

✦ 1: Meet the Millionaire Next Door

The common image of millionaires – flashy, ostentatious spenders – is often far from reality. Many hold preconceptions about the wealthy, picturing them adorned in expensive attire and driving luxurious vehicles. The truth often defies these expectations. A trust officer relayed an experience where he struggled to reconcile his image of a millionaire with the reality of the people he met, reinforcing how deceiving appearances can be. Texans have a phrase for those who present an image of wealth without substance: “Big hat, no cattle”.

Millionaires have been researched, and it has found that some prevalent characteristics that distinguish them. Picture this typical American millionaire: a 57-year-old male, married with three children. He’s likely to earn the majority of the household income, and around one in five are already retired. Of those still working, most are self-employed, often identifying as entrepreneurs. Forget glamorous industries; many millionaires operate “dull-normal” businesses. They run welding firms, auction houses, farms, or mobile-home parks. Often, their wives don’t work outside the home, but if they do, teaching is a common profession. Though the average household income might be around \$247,000, the *median* is a more modest \$131,000, reflecting how a few very high earners skew the average. The average household net worth stands at \$3.7 million, but the median millionaire household is worth \$1.6 million. A key point is that these millionaires typically live on less than 7% of their wealth annually.

Most are homeowners, often residing in the same house for over two decades, and about 80% are first-generation affluent, meaning they didn’t inherit their wealth. Frugality is a hallmark, seen in their modest clothing and American-made vehicles. Wives are often meticulous planners and budgeters. A sizable “go-to-hell fund” is common, representing enough wealth to live comfortably for a decade or more without working.

While their non-millionaire neighbors may outnumber them three to one, the millionaires possess significantly more wealth. Education is highly valued, with many holding advanced degrees, and they prioritize their children’s education. These individuals are diligent investors, allocating about 20% of their household income each year, making their own investment decisions.

Wealth, in reality, isn’t about possessions but about financial independence. It’s about owning “cattle” (assets) rather than “chattel” (material goods). A millionaire is defined as someone with a net worth of \$1 million or more, and they account for a small percentage of American households. Expected net worth is strongly influenced by age and income. Someone significantly exceeding their expected wealth level is considered wealthy within their income/age group. Those who excel at building wealth relative to their income and age are called Prodigious Accumulators of Wealth (PAWs), while those who lag behind are Under Accumulators of Wealth (UAWs). PAWs can have four times the wealth of UAWs in the same income bracket, showcasing the impact of lifestyle and financial choices.

✦ 2: Frugal Frugal Frugal

Frugality stands as a foundational pillar in building wealth. Despite the media often sensationalizing big spenders, accumulating wealth hinges on a dedication to economical resource management. While we’re constantly bombarded with images of millionaire athletes and their lavish lifestyles, true affluence often looks quite different. Someone earning \$5 million a year might be technically a millionaire, but if their net worth doesn’t reflect that high income, it’s clear where the money is going.

The typical millionaire is frugal and often doesn’t reach millionaire status until later in life. It’s difficult to reconcile a high-consumption lifestyle with genuine wealth accumulation. We see young people, influenced by media portrayals, believe that lavish spending is a hallmark of affluence, but in reality, most wealth is accumulated through hard work and thrift, characteristics that are often overlooked. Many people, particularly those who struggle to build wealth, readily spend any increase in income, prioritizing immediate gratification.

A program showcasing a typical millionaire might not be exciting television. A segment featuring Johnny Lucas, a 57-year-old owner of a janitorial company, married with a modest lifestyle, wouldn’t fit the common expectation of wealth. His frugality, traditional values, and disciplined approach to finances might even make viewers uncomfortable.

Consider clothing: the average millionaire has likely never spent more than \$399 on a suit. Most don’t need to impress high-powered clients or stockholders; they need to manage their businesses effectively. Those expensive suits are often purchased by high-income earners who aren’t millionaires, contributing to their struggle to build wealth.

What about shoes? The average millionaire likely hasn’t spent more than \$140 on a pair. The media attention given to extravagant purchases, like a boxing promoter buying 110 pairs of expensive shoes, distorts the reality of how most affluent individuals manage their finances.

Millionaires also tend to wear modest watches. They understand that financial independence is achieved through managing finances prudently. They often own their homes outright and have fully funded their children’s education.

The affluent answer “yes” to certain questions about frugality, including whether their parents were frugal, if they are frugal themselves, and if their spouse is even more frugal than they are. While generating a high income is important, millionaires also play “great defense,” controlling their spending. They budget, plan, and ensure their financial future.

People like Mrs. Jane Rule, who runs an auctioneering company, exemplify this approach. They operate on a budget, know how much they spend on essential items, and have clear financial goals. Credit cards also offer insight: millionaires are more likely to have a Sears card than a Brooks Brothers card.

Ultimately, building wealth involves minimizing taxable income and maximizing wealth appreciation without generating immediate cash flow. This requires discipline and a focus on long-term financial security. The affluent are masters at minimizing their realized income, understanding that the more they spend, the more they are taxed.

✦ 3: Time, Energy, and Money

Allocating resources effectively, including time, energy, and money, is crucial for wealth accumulation. It’s not enough to simply earn a high income; you also need to manage those resources wisely. We all have limited amounts of these resources, and how we choose to allocate them significantly impacts our financial success.

Consider two hypothetical individuals, Dr. North and Dr. South, with differing approaches to life. Dr. North prioritizes long-term financial security and independence. He carefully plans his investments, spends conservatively, and allocates a significant amount of time managing his finances. In contrast, Dr. South focuses on immediate gratification and displays a high-consumption lifestyle. He spends more freely, investing less time in financial planning, and prioritizing leisure activities. While both may earn similar incomes, their differing habits lead to vastly different financial outcomes. Dr. North accumulates significantly more wealth over time, demonstrating the power of disciplined resource allocation.

The differences extend beyond financial matters. Dr. North tends to be more concerned about financial independence, while Dr. South is more worried about what others think of him. Dr. North is more likely to purchase products based on their intrinsic value and utility, whereas Dr. South is influenced by social status and brand names. These contrasting attitudes underscore the importance of aligning your values and priorities with your financial goals.

We can further classify individuals into Prodigious Accumulators of Wealth (PAWs) and Under Accumulators of Wealth (UAWs). PAWs are adept at building wealth relative to their income and age. They are efficient at allocating their time, energy, and money towards wealth-building activities. They are generally more disciplined, focused, and resourceful. On the other hand, UAWs struggle to accumulate wealth, even with high incomes. They often prioritize consumption over investment and tend to be less organized and strategic in their financial planning.

The key difference lies in how these groups spend their time. PAWs allocate more time to managing investments and planning their financial futures. They view this as a worthwhile investment of their time and energy. UAWs, conversely, spend less time on financial matters and more time on leisure activities or non-essential tasks. This difference in time allocation has a significant impact on their ability to build wealth. PAWs understand that time is a valuable asset and use it strategically to achieve their financial goals. UAWs often underestimate the importance of financial planning and fail to prioritize it in their daily lives.

Ultimately, wealth accumulation is not solely about earning a high income; it’s about making conscious decisions regarding how to allocate your limited resources. By prioritizing financial planning, managing expenses wisely, and investing for the future, individuals can significantly increase their chances of achieving financial independence. The choice is ours: to emulate Dr. North and become PAWs or follow in the footsteps of Dr. South and remain UAWs. The effective management of time, energy, and money is the key to unlocking financial success.

✦ 4: You Aren’t What You Drive

The car one drives says a lot about them, or at least, that’s what many people believe. However, judging someone’s wealth based on their vehicle can be misleading. We’ve found that many millionaires don’t drive the latest models or expensive luxury cars. Instead, they prioritize value, reliability, and practicality over status symbols. It challenges the common perception that wealth is synonymous with driving flashy, high-end vehicles.

Many non-millionaires, despite earning far less, often lease or purchase expensive cars to project an image of success. It’s a way of signaling status, but it comes at a financial cost that hinders their ability to accumulate wealth. They often lease vehicles, always wanting the newest model, trapping themselves in a cycle of debt. In contrast, millionaires tend to buy used cars or keep their vehicles for many years, understanding that a car is primarily a means of transportation, not a statement of identity.

We’ve found a significant correlation between the type of car one drives and their net worth. Millionaires are more likely to drive American-made cars and pay cash for them. They avoid leasing and prioritize long-term value over short-term gratification. People who lease cars, on the other hand, often have lower net worth, indicating that their spending habits prioritize appearance over financial prudence.

Consider a hypothetical scenario: two neighbors, Mr. Smith and Mr. Jones. Mr. Smith drives a new luxury car and frequently boasts about its features. Mr. Jones, on the other hand, drives an older, less flashy car. Most people would assume Mr. Smith is wealthier. However, Mr. Jones is the millionaire next door, while Mr. Smith is struggling with debt to maintain his image.

The car-buying habits of millionaires reflect their overall approach to finances: they are frugal, practical, and prioritize long-term financial security over short-term status. They understand that true wealth is not about what you show the world, but what you accumulate over time. This chapter encourages readers to re-evaluate their own car-buying habits and consider whether they are driving their wealth away. It emphasizes that a sensible car choice can free up resources for investments and contribute to long-term financial success. Ultimately, it’s better to be a millionaire driving a modest car than to appear wealthy while struggling financially.

✦ 5: Economic Outpatient Care

Economic outpatient care, often provided by affluent parents to their adult children, can significantly hinder wealth accumulation for both generations. While the intention is often to help, such support can inadvertently foster dependency and prevent children from developing the self-reliance necessary to build their own wealth. We are not suggesting that parents should never help their children, but the manner and timing of this help are crucial.

Consider a hypothetical scenario. Parents provide substantial financial assistance to their adult children, covering expenses like housing, car payments, and even discretionary spending. While the children may enjoy a comfortable lifestyle, they are less likely to develop the habits of frugality, hard work, and financial responsibility that are essential for long-term success. These parents may also compromise their own financial security, potentially delaying their retirement or limiting their ability to pursue their own goals.

The impact of economic outpatient care extends beyond financial matters. Children who receive such support may develop a sense of entitlement, believing that their parents have an obligation to provide for them indefinitely. This can lead to strained relationships, as parents may feel resentful of their children’s dependence, while children may feel that their parents are not doing enough. It’s a delicate balance between supporting loved ones and fostering self-sufficiency.

We’ve found that millionaires often take a different approach. While they may provide their children with a good education and a strong foundation in life, they typically refrain from offering ongoing financial assistance. Instead, they encourage their children to pursue their own careers, make their own financial decisions, and learn from their own mistakes. They instill in them a sense of responsibility and the importance of earning their own success.

This approach benefits both generations. The children are more likely to develop the skills and habits necessary to build wealth, while the parents are able to maintain their own financial security and enjoy their retirement years. It’s a win-win situation that fosters independence, responsibility, and strong family relationships.

There are exceptions, of course. In some cases, adult children may face genuine hardships that warrant parental support. However, even in these situations, it’s important to provide assistance in a way that encourages self-sufficiency. This might involve offering temporary support while the child seeks employment or providing guidance on financial management. The key is to help the child get back on their feet without creating long-term dependence.

Ultimately, the decision of whether or not to provide economic outpatient care is a personal one. However, it’s important to carefully consider the potential consequences for both generations. By fostering independence, responsibility, and financial literacy, parents can help their children build their own wealth and achieve long-term success. It’s a gift that will last a lifetime.

✦ 6: Affirmative Action, Family Style

Giving financial gifts to adult children can have complex and often unintended consequences on their ability to accumulate wealth. While parents may want to assist their children, substantial and ongoing financial support can actually hinder their financial independence and self-sufficiency. It’s a delicate balance between providing a safety net and fostering dependence. We aim to shed light on the impact these financial dynamics have on both parents and their adult children.

Consider the economic advantages of being raised in a high-income household. Children from affluent families typically receive a superior education, have access to better healthcare, and benefit from a more enriching environment. These advantages can significantly increase their earning potential and overall well-being. While these are inherent benefits, direct monetary gifts can disrupt the trajectory.

We’ve discovered that parents providing significant financial gifts to their adult children often impede their children’s motivation to achieve financial independence. When children know they can rely on their parents for financial support, they may be less inclined to work hard, save diligently, and make responsible financial decisions. It fosters a sense of entitlement, undermining the very qualities that contribute to wealth accumulation.

It can also create a cycle of dependence, where children come to expect financial assistance from their parents indefinitely. This can strain family relationships, as parents may feel resentful of their children’s dependence, while children may feel entitled to their parents’ support. It becomes a difficult pattern to break, with potential long-term consequences for all involved.

Moreover, providing substantial financial gifts to adult children can compromise the parents’ own financial security. Parents may delay their retirement, reduce their savings, or limit their ability to pursue their own goals. It’s a significant sacrifice that can impact their quality of life in later years. We want to make sure that everyone has a roadmap for continued financial stability.

Interestingly, we’ve found that millionaires often take a different approach. While they may provide their children with a solid education and a strong moral compass, they typically avoid giving them substantial financial gifts. Instead, they encourage their children to pursue their own careers, manage their own finances, and learn from their own mistakes. They instill in them a sense of responsibility and the importance of earning their own success.

This approach benefits both generations. The children are more likely to develop the skills and habits necessary to build wealth, while the parents are able to maintain their own financial security and enjoy their retirement years. It’s a win-win situation that fosters independence, responsibility, and strong family relationships.

There are instances where adult children face genuine hardships and require parental support. However, even in these cases, it’s crucial to provide assistance in a way that promotes self-sufficiency. Temporary support, financial guidance, or help finding employment can be more effective than ongoing financial gifts.

Ultimately, the decision of whether or not to provide financial assistance to adult children is a personal one. However, it’s vital to carefully consider the potential consequences for both generations. Fostering independence, responsibility, and financial literacy can help children build their own wealth and achieve long-term success, benefiting the entire family.

✦ 7: Find Your Niche

Estate planning and related fees can significantly impact the transfer of wealth from one generation to the next. Many millionaires understand the importance of minimizing these costs to maximize the inheritance for their heirs. We’ve observed that finding a niche, a specialized area of expertise, can be crucial for both building wealth and preserving it for future generations.

Consider the allocation of estates valued at \$1 million or more. Substantial portions are often designated for federal estate taxes, state death taxes, and estate administration fees. This leaves a smaller percentage for the intended heirs. It highlights the importance of effective estate planning to minimize these costs.

These are substantial sums, emphasizing the need for careful planning and expert advice to minimize the impact of fees. Many high-earning professionals and business owners focus on what we might term, “playing offense” in generating wealth. However, they often ignore the significance of “playing defense” by implementing effective estate planning strategies. A failure to plan means that a significant portion of your wealth will go to unintended parties: government agencies and service providers.

We’ve observed that many millionaires are actively engaged in finding a niche, a specific area of expertise, for themselves and their children. This allows them to command higher fees for their services, increasing their earning potential and maximizing their wealth-building opportunities. It also applies to preserving wealth. The key is to acquire specialized knowledge or skills that are in high demand, this is how they stand out from the competition and attract affluent clients.

For example, an attorney might specialize in estate planning for owners of closely held businesses. A financial advisor might focus on developing investment strategies for high-net-worth individuals. These niches allow them to provide more specialized and valuable services, command higher fees, and build a strong reputation within their chosen area. By differentiating themselves, they’ll gain an advantage in the marketplace.

Estate planners suggest lifetime gifting strategies to minimize estate taxes. By gifting assets to heirs during their lifetime, millionaires can reduce the size of their estate and lower the overall tax burden. This requires careful planning and a thorough understanding of tax laws, but it can be a highly effective way to preserve wealth for future generations.

Many millionaires prioritize educating themselves about estate planning strategies and working closely with qualified professionals. They understand that the fees they pay for expert advice are a worthwhile investment, as they can save significant amounts in taxes and administrative costs. Planning for the distribution of one’s estate is a complex process, but it’s essential for ensuring that your assets are transferred to your loved ones in the most efficient and cost-effective manner possible. The more you understand the process, the better you’ll preserve the wealth for your family.

Ultimately, finding a niche is about identifying your unique skills and talents and using them to create value for others. By combining specialized knowledge with a commitment to providing excellent service, you can build a successful career, accumulate wealth, and ensure that your legacy is passed on to future generations.

✦ 8: Jobs: Millionaires versus Heirs

The career paths taken by millionaires often differ significantly from those chosen by individuals who inherit their wealth. We’ve found that self-made millionaires are more likely to be entrepreneurs, small business owners, or professionals in fields that offer autonomy and direct financial rewards. In contrast, those who inherit wealth may pursue careers based on personal interests or social status rather than financial gain. It’s about understanding these different motivations.

Consider the occupational choices of self-made millionaires. They frequently work in industries that are not necessarily glamorous but offer ample opportunities for wealth accumulation. They might own construction companies, operate janitorial services, or run small retail businesses. These professions often require hard work, dedication, and a willingness to take risks, but they also provide a direct link between effort and financial success.

We’ve observed that self-made millionaires prioritize financial independence and are willing to make sacrifices to achieve it. They often choose careers that allow them to control their income, make their own decisions, and build equity in their own businesses. They view their work as a means to an end: financial freedom.

On the other hand, individuals who inherit wealth may have different priorities. They may be less driven by financial necessity and more interested in pursuing careers that align with their passions or social values. They might become artists, academics, or philanthropists. While these careers can be fulfilling, they may not offer the same potential for wealth accumulation.

It’s not to say that heirs cannot be successful entrepreneurs or that self-made millionaires never pursue careers in the arts or academia. However, there is a general trend that reflects differing motivations and priorities. Self-made millionaires are often driven by the need to create wealth, while heirs may be more focused on maintaining or using wealth for other purposes.

We see that the types of jobs millionaires hold are diverse. One way to approach the choice of career is to find a niche market. A wealth advisor helping other people plan their estates could be the job. Similarly, self-made millionaires often identify market opportunities and develop specialized skills to capitalize on them. They might focus on serving a particular demographic, providing a unique product or service, or targeting an underserved market. This allows them to differentiate themselves from the competition and command higher fees for their expertise.

Contrast to millionaires, what are the occupations of those who inherited their wealth? Many have never worked, and inherited wealth can often breed a sense of entitlement and reduce the motivation to work hard.

Ultimately, the choice of career depends on individual goals, values, and circumstances. However, anyone aspiring to build wealth should carefully consider the financial implications of their career choices and seek opportunities that offer the greatest potential for financial independence. By adopting the mindset and habits of self-made millionaires, anyone can increase their chances of achieving financial success, regardless of their background or circumstances.

For People

– Aspiring Millionaires

– Young Adults

– Financial Planners

– Marketing Professionals

– Anyone in Debt

Learn to

– Frugality

– Financial Independence

– Wealth Accumulation

– Investment Strategies

– Financial Planning